Introduction

Foreign exchange (forex or FX) trading is the global marketplace for buying and selling currencies. With an average daily trading volume exceeding $7 trillion, the forex market is the largest and most liquid financial market in the world. Unlike stock markets, forex operates 24 hours a day, five days a week, due to the continuous demand for currency trading worldwide.

Understanding Forex Trading

Forex trading involves exchanging one currency for another to profit from changes in exchange rates. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is the “base currency,” and the second is the “quote currency.”

For example, if EUR/USD is trading at 1.2000, it means 1 Euro is worth 1.20 US Dollars. If the exchange rate increases, the Euro strengthens against the Dollar, and traders who bought Euros profit.

Key Participants in the Forex Market

Several entities engaged in forex trading including:

1. Banks and Financial Institutions

The primary drivers of the forex market, conducting large transactions for clients and speculative purposes. There are four major banks in the forex market:

JP Morgan

Citigroup

Barclay

Deutsche bank

These entities often have substantial trading volumes and the power to move markets through their buying or selling actions. They cause prices to go up and down in the market

2. Central Bank

Governments and central banks influence forex markets by setting interest rates and monetary policies. Central Banks are responsible for managing a country’s monetary policy and regulating the country’s money and interest rates.

Key central banks are, the European Central Bank, the Bank of England, and the Federal Reserve.

3. Retail Trader

Individual traders who participate through online trading platforms. Retail traders often have less capital, fewer analytical tools, and limited access to advanced trading technologies compared to their institutional counterparts.

Corporations

4. Businesses engage in forex trading to manage currency risk when operating in multiple countries. Large multinational companies also has an impact on the forex market. If two big company start to transfer funds between currencies it can influence the market.a

How Forex Trading Works

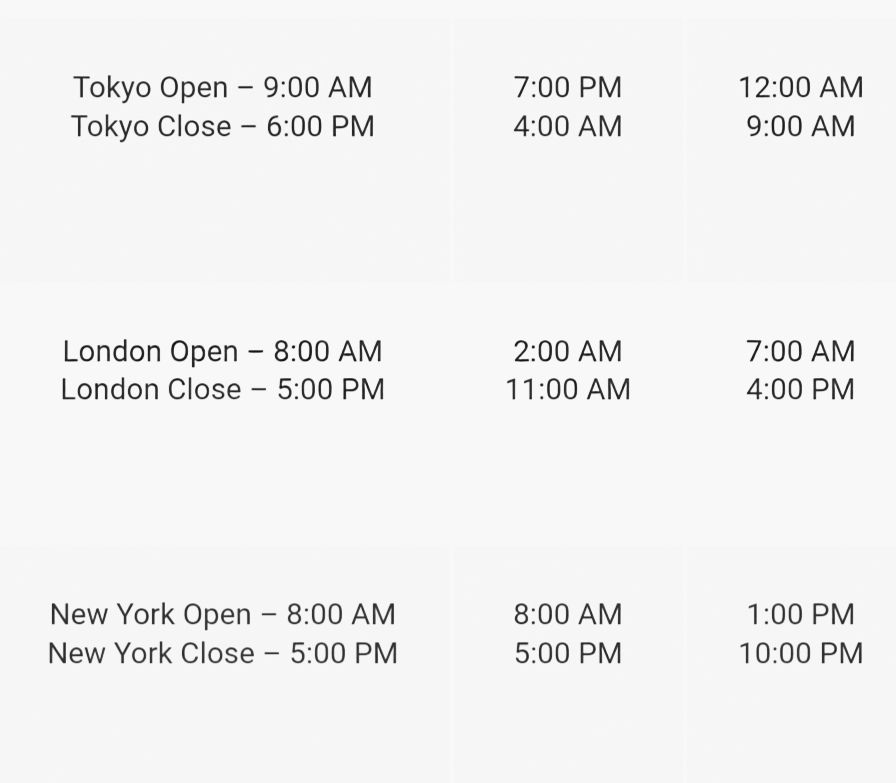

Forex trading occurs over-the-counter (OTC), meaning it is decentralized and conducted electronically through a network of banks, brokers, and liquidity providers. Trading is divided into three main sessions:

Asian Session (Tokyo)

The first market to open, heavily influenced by the Japanese Yen.

European Session (London)

The most liquid session, as it overlaps with both Asian and US trading hours.

American Session (New York)

A crucial session due to the US dollar’s dominance in global trade.

Trading Strategies

Forex traders employ various strategies, including:

1. Scalping – Making multiple trades per day to profit from small price movements.

2. Day Trading – Opening and closing positions within a single day to avoid overnight risks.

3. Swing Trading – Holding positions for several days to capitalize on medium-term trends.

4. Position Trading – A long-term strategy where traders hold positions for weeks or months.

Leverage and Margin in Forex Trading

Leverage and margin are key concepts in forex trading that allow traders to control large positions with a relatively small amount of capital.

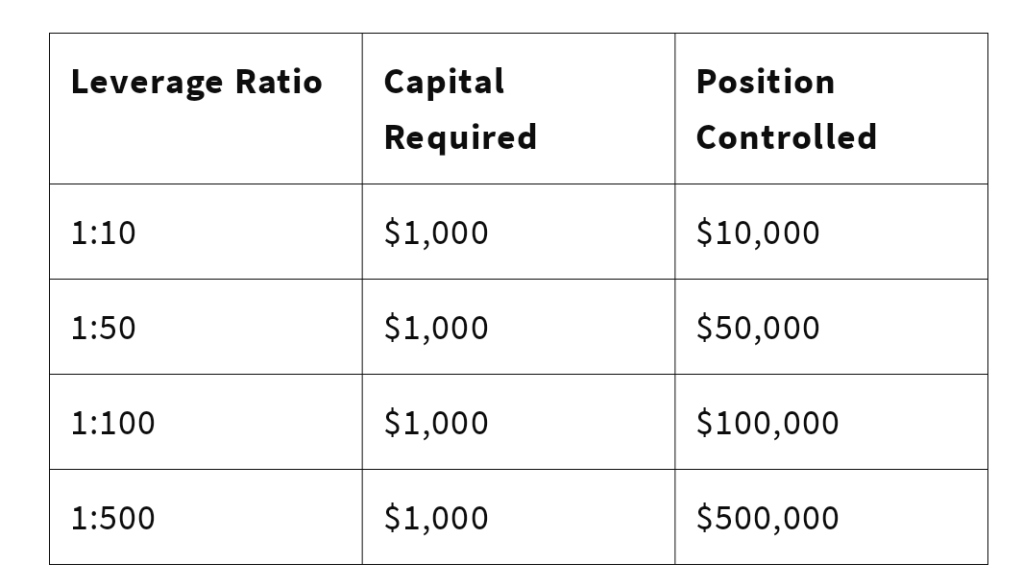

1. Leverage

Leverage is the use of borrowed funds to increase the potential return on investment. In forex trading, brokers offer leverage to allow traders to control a larger position than they could with their own funds alone.

How Leverage Works

If a broker offers 1:100 leverage, it means you can control a position 100 times larger than your actual capital.

For example, with a $1,000 deposit and 1:100 leverage, you can trade a position worth $100,000.

Common Leverage Ratios

Pros and Cons of Leverage

✅ Advantages:

Allows traders to control larger positions.

Increases the potential for higher profits.

❌ Disadvantages:

Higher risk of losses, as losses are also magnified.

Can lead to margin calls if the trade goes against you.

2. Margin

Margin is the amount of money required to open and maintain a leveraged position. It acts as a security deposit that a broker holds to ensure you can cover potential losses.

How Margin Works

Margin Requirement: Expressed as a percentage of the total trade size.

Example: If a broker requires a 1% margin, and you open a $100,000 trade, you need to deposit $1,000 as margin.

Types of Margin

1. Initial Margin (Required Margin): The minimum amount needed to open a position.

2. Maintenance Margin: The minimum balance required to keep the position open.

3. Margin Call: If losses reduce your account balance below the required margin, the broker may request additional funds or close positions.

Margin Calculation Formula

\text{Margin} = \frac{\text{Trade Size}}{\text{Leverage}}

Trade size: $50,000

Leverage: 1:100

Margin required: USD

3. Relationship Between Leverage and Margin

Higher leverage = Lower margin requirement (less capital needed to open trades).

Lower leverage = Higher margin requirement (more capital needed but lower risk).

Example Comparison:

| Leverage | Trade Size | Required Margin | |———-|———–|—————-| | 1:50 | $100,000 | $2,000 (2%) | | 1:100 | $100,000 | $1,000 (1%) | | 1:500 | $100,000 | $200 (0.2%) |

4. Risk Management with Leverage and Margin

To avoid excessive losses:

✔ Use lower leverage (e.g., 1:10 or 1:50 for beginners).

✔ Set Stop-Loss orders to limit risk.

✔ Maintain a healthy margin level to avoid margin calls.

✔ Never risk more than 1-2% of your capital per trade.

Would you like help calculating leverage or margin for a specific trade?

Forex brokers offer leverage, allowing traders to control larger positions with smaller capital. For example, 1:100 leverage means a trader can control a $10,000 position with just $100. While leverage increases profit potential, it also amplifies risks.

Factors Influencing Forex Market

Several factors affect currency prices, including:

1. Interest Rates – Higher interest rates attract investors, strengthening a currency.

2. Inflation – Low inflation supports a stronger currency, while high inflation weakens it.

3. Economic Data – Reports like GDP, employment rates, and consumer spending impact forex markets.

4. Geopolitical Events – Wars, elections, and economic policies create volatility.

Risks and Challenges in Forex Trading

While forex trading offers opportunities, it also carries risks:

Market Volatility – Sudden price swings can lead to significant losses.

Leverage Risks – Excessive leverage can wipe out an account quickly.

Emotional Trading – Fear and greed can lead to poor decision-making.

Lack of Knowledge – Many beginners lose money due to a lack of experience and understanding.

Tips for Successful Forex Trading

1. Educate Yourself – Learn about forex markets, strategies, and risk management.

2. Use a Demo Account – Practice trading without real money to gain experience.

3. Develop a Trading Plan – Set clear goals, risk limits, and strategies.

4. Control Emotions – Stick to a strategy and avoid impulsive trading.

5. Keep Up with Market News – Stay informed about economic events that affect currency movements.

Conclusion

Forex trading is a dynamic and potentially profitable market, but it requires knowledge, discipline, and risk management. Whether you’re a beginner or an experienced trader, continuous learning and a solid strategy are key to success in the forex market.